Our Process

- Current Financial Situation

- Hopes, Dreams and Crystal Balls (boring finance jargon: Purpose, Objective & Time Horizon)

- Your Investment Experience

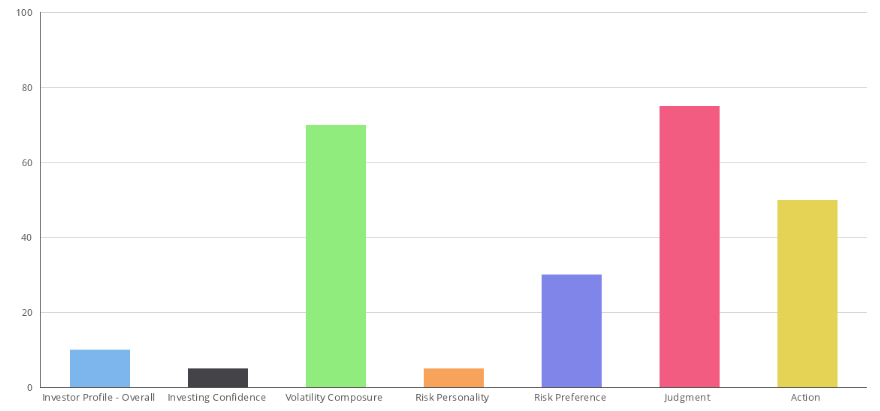

- Risk Profile & Behaviors

- Account Selection

- Portfolio Design

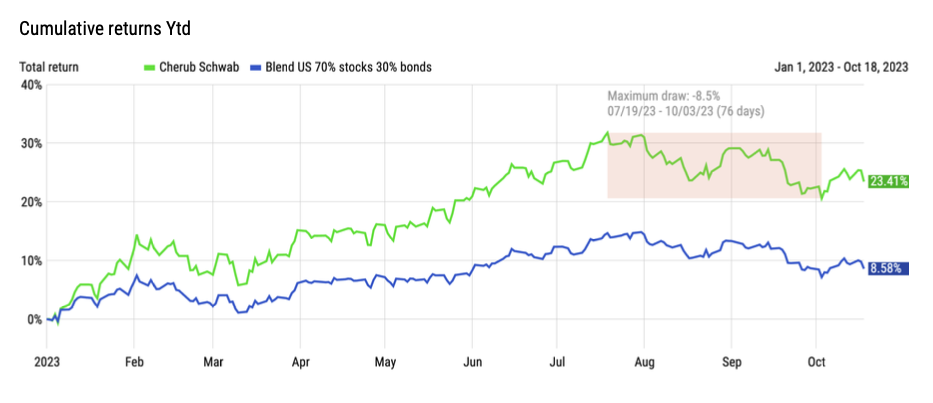

- Investment Monitoring

Investment Philosophy

Investment Philosophy

Control investment expenses by selecting low cost funds

Reduce risk by diversifying portfolio assets (not putting all our eggs in one basket)

Fundamental analysis to identify undervalued investment options

We primarily invest in Exchange Traded Funds as we believe they are more tax efficient than Mutual Funds

Our approach is passive (we're not day trading)

Past performance does not guarantee future returns